Let's get one thing straight: if you thought the stock market in China was just having a "bad quarter," you’re in for a rude awakening. For the last four years, the Chinese stock market has been in a tailspin, wiping out $6.5 trillion in value. Yes, you read that right—trillion. Compare that to the bull run in the rest of the world, and you’ll realize China’s economy isn’t just wobbling, it's gasping for air.

I know what you’re thinking: “What happened to the ‘economic miracle’ we kept hearing about?” Well, stick around because I’m about to break it down for you. From government stimulus measures that are like band-aids on a broken leg to the relentless global stock market competition, China’s stock market is a case study in how bad things can get, even when the rest of the world is thriving.

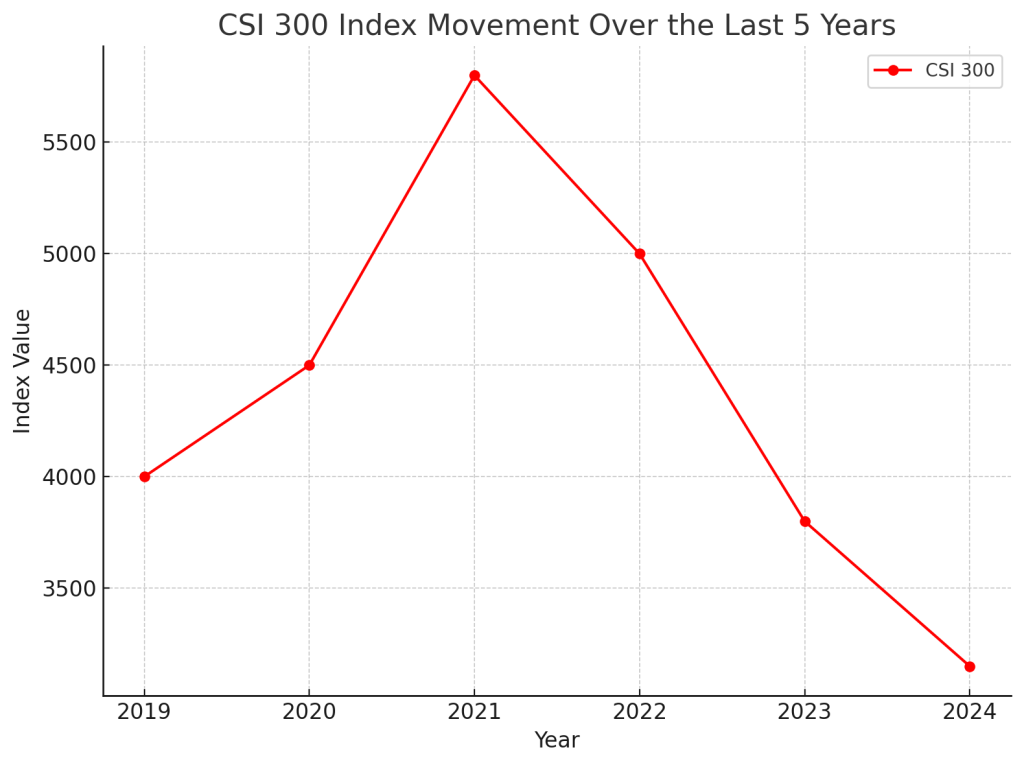

The CSI 300: A 4-Year Crash That’s Far From Over

Let’s start with the numbers. The CSI 300 Index—which tracks the top 300 stocks on the Shanghai and Shenzhen exchanges—has dropped more than 45% in just over three years. If you had invested $10,000 in February 2021, it would now be worth a heartbreaking $5,450. And it’s not like the rest of the world was sharing China’s pain—stock markets globally have surged during the same period.

Table: How Much You’ve Lost in the Chinese Stock Market

| Date | CSI 300 Index | Value of $10,000 Investment |

|---|---|---|

| Feb 2021 | 5,800 | $10,000 |

| Oct 2024 | 3,100 | $5,450 |

That’s a 45% nosedive in your portfolio. Ouch.

But here’s the kicker: the Chinese government has been trying to pull the stock market out of its spiral with every trick in the book. They’ve cut stamp duties, imposed short-selling restrictions, and even started buying stocks directly through government-backed funds. And yet, the market keeps tanking. If anything, these measures have delayed the inevitable: a full-on market collapse.

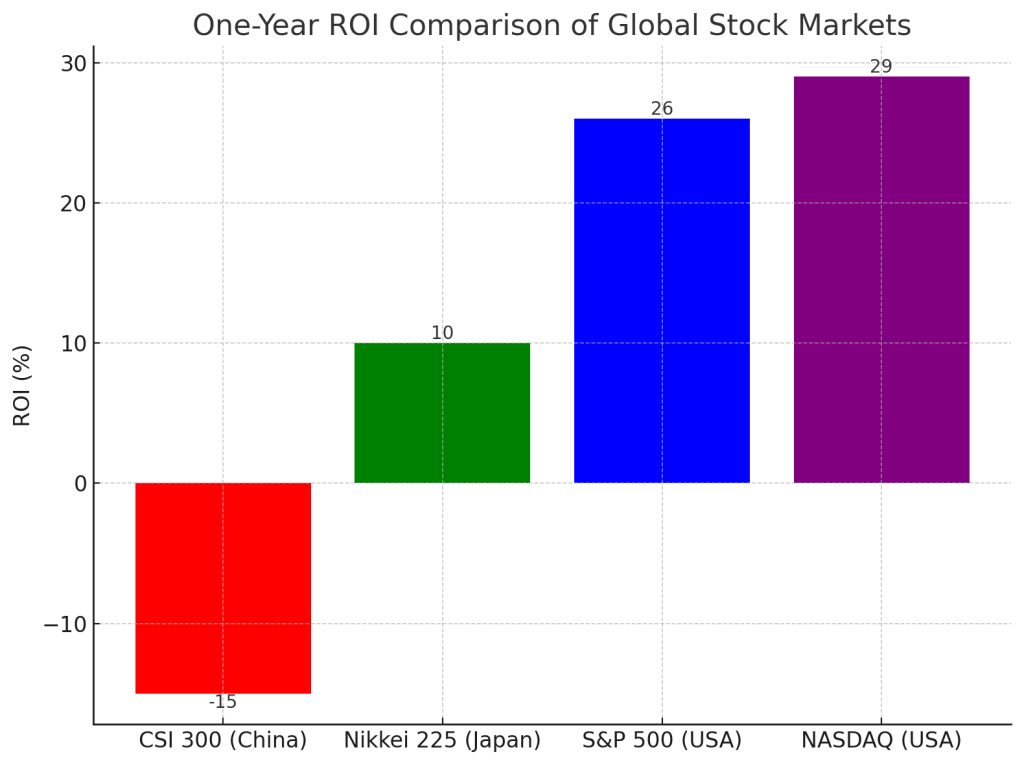

The Global Comparison: China vs. The Rest of the World

Now let’s pull the curtain back and look at how China stacks up against other major stock markets. Spoiler alert: it doesn’t look good.

How Global Markets Are Crushing China

| Market | Index Movement | One-Year ROI |

|---|---|---|

| CSI 300 (China) | -15% | $8,500 |

| Nikkei 225 (Japan) | +10% | $11,000 |

| S&P 500 (USA) | +26% | $12,600 |

| NASDAQ (USA) | +29% | $12,900 |

As you can see, while China’s stock market has lost 15% in the last year alone, major indexes like the S&P 500 and NASDAQ are crushing it, yielding returns of 26% and 29% respectively. That’s a $12,900 return on your $10,000 investment in the NASDAQ—talk about a missed opportunity.

Visual: One-Year ROI Comparison of Global Stock Markets

So why has China been left in the dust?

Stimulus: A Flawed Attempt to Stop the Bleeding

The Chinese government has thrown everything but the kitchen sink at this problem, and yet, nothing seems to stick. In August 2023, they slashed stamp duty and imposed short-selling restrictions to prevent hedge funds from tanking stock prices. For a hot minute, it worked. Prices started to inch up, but that didn’t last.

Here’s a breakdown of the government stimulus measures and why they failed:

- Stamp Duty Cuts: Reduced transaction costs to encourage buying, but didn’t address the deeper economic issues plaguing the market.

- Short-Selling Restrictions: Temporarily reduced downward pressure on stocks but scared off investors, leading to reduced liquidity.

- Direct Stock Purchases: Created a short-term bump, but didn’t change the underlying fundamentals.

Global Pressure and China’s Isolation

In 2021, China’s stock market started its descent into the red, even as the world started rebounding from the pandemic. Why? The global landscape has shifted dramatically, and China’s economy, once an unstoppable juggernaut, now looks like it’s running out of steam.

Let’s not forget the Ukraine war, which led to skyrocketing commodity prices. Although China isn’t involved in the conflict, it’s a major commodity buyer, and the ripple effects hit its economy hard. The result? More uncertainty in a market already on shaky ground.

Visual: CSI 300 Index Movement Over the Last 5 Years

What Does the Future Hold?

Here’s the million-dollar question: Where is China’s stock market going? Unfortunately, it’s not looking good. The government’s efforts, though valiant, are not sufficient, and foreign investors are pulling out.

Possible Scenarios for the Next 6-12 Months

- Continued Decline: The market could lose another 10-20% if the economy doesn’t stabilize.

- Flat Growth: The government could step in with even more aggressive measures, resulting in a stagnation rather than a recovery.

- Miracle Recovery: Let’s be honest—this seems unlikely unless there’s a major policy overhaul.

Wrapping It Up: The China Stock Market Is in Trouble

China’s stock market is like a canary in a coal mine. Its collapse isn’t just a blip—it’s a flashing red warning that the economy is in serious trouble. With $6.5 trillion wiped out, a property market in chaos, and GDP growth missing targets, it’s hard to see a silver lining here.

So, what’s your take? Are we seeing the beginning of a larger economic crisis in China? Or is this just a phase that will pass? Drop your thoughts in the comments below, and let’s get a conversation started.

And while you're at it, why not become a permanent resident or citizen of the "Shining City on the Web"? Join the iNthacity community where we discuss the latest in tech, economics, and innovation. Like, share, comment—and become part of the debate.

Disclaimer: This article may contain affiliate links. If you click on these links and make a purchase, we may receive a commission at no additional cost to you. Our recommendations and reviews are always independent and objective, aiming to provide you with the best information and resources.

Get Exclusive Stories, Photos, Art & Offers - Subscribe Today!

Post Comment

You must be logged in to post a comment.