Russia’s economy is like that old car you keep patching up with duct tape—no matter how hard you try, it just keeps breaking down. And now, with the Ruble spiraling down the drain, Moscow is turning to China’s Yuan like a life raft. But is it too late to stop Russia’s economy from sinking?

The Ruble’s Fall: A Slow-Motion Economic Car Crash

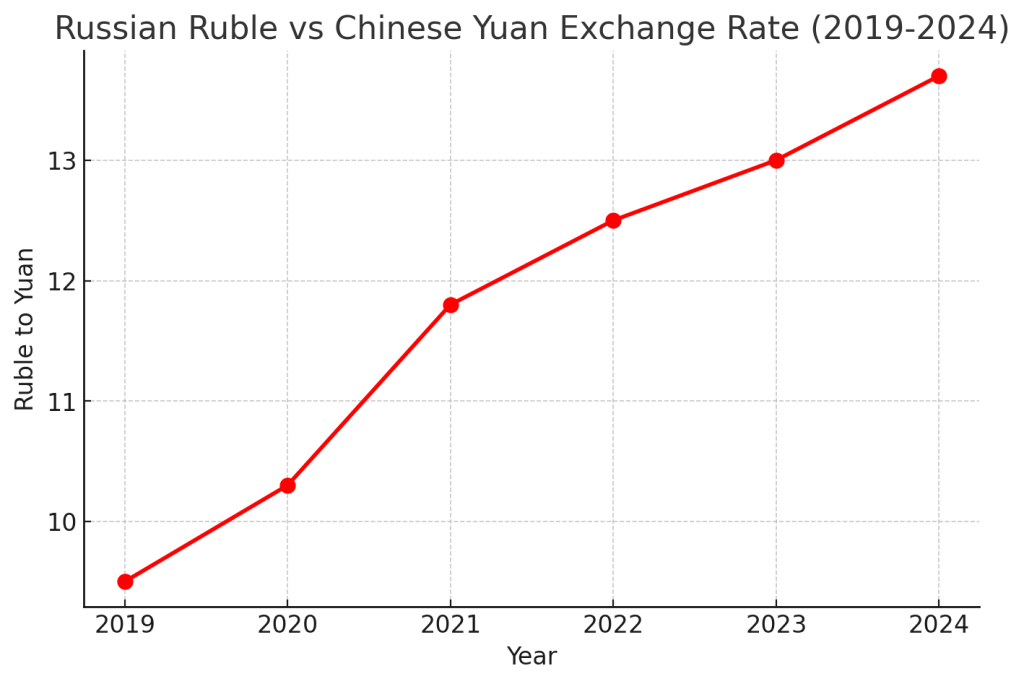

It’s hard to overstate how much the Ruble has tanked since Russia’s 2022 invasion of Ukraine. Picture this: back in 2021, the Ruble was trading around ₽75 to $1. Fast forward to today, and you’re looking at ₽92 to $1, a 22% nosedive in three years. But the real kicker? The Ruble’s value against the Chinese Yuan has crumbled even harder, a 45% drop in five years.

You’d think the Russian government would have learned a thing or two from their past mistakes. But instead of shoring up their own currency, they’re doubling down on the Yuan. In fact, as of June 2024, a staggering 99.6% of all Russian foreign exchange trades were done in Yuan. Yeah, you read that right: the Ruble has been all but replaced in international trade. Russia has essentially yuanized its economy.

Line Chart: Ruble vs Yuan Over Five Years

Why is Russia So Obsessed with the Yuan?

Let’s break this down. When Russia first invaded Ukraine, Vladimir Putin had a wild dream: to force countries to pay for Russian exports in Rubles, making the Russian currency a serious contender on the global stage. Spoiler alert: it didn’t work. India, one of Russia’s biggest oil buyers, flat-out refused to deal in Rubles. So did China. Both countries insisted on paying in their own currencies—Yuan in China’s case and Dirhams for the United Arab Emirates.

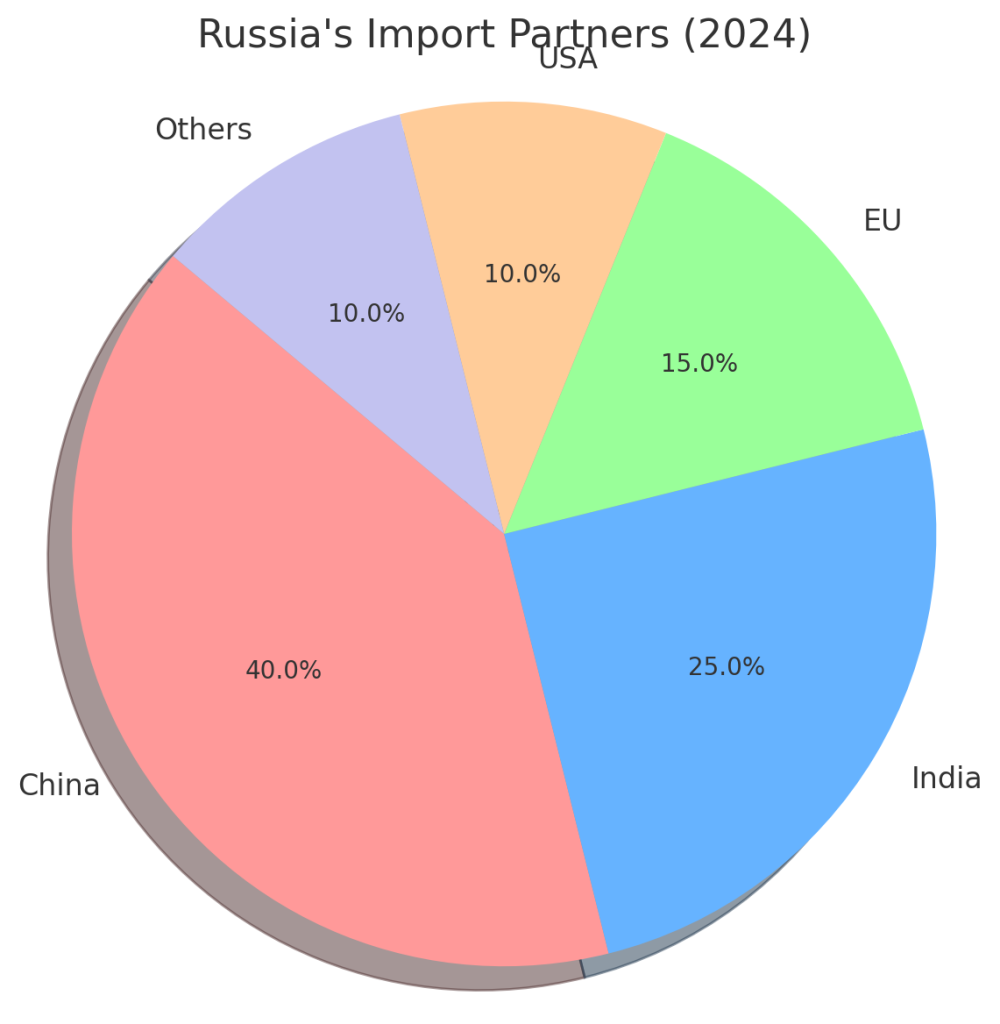

The result? Russia’s financial system now heavily depends on Chinese currency. Almost half of Russia’s imports—40%—come from China, meaning Russian companies need large amounts of Yuan to keep their businesses running. But here’s where it gets dicey: Russia’s top exporters (like oil and gas companies) are stockpiling Yuan, while importers are scrambling to get their hands on it. This mismatch is sparking a full-blown liquidity crisis.

Liquidity Crisis 101: Russia’s Yuan Problem

What does it mean when we say Russia is facing a liquidity crisis? In simple terms: they’re running out of cash—or more specifically, they’re running out of Yuan. Russian importers, desperate to pay their Chinese suppliers, are borrowing more and more Yuan from the Russian Central Bank, but the bank doesn’t have an endless supply of Chinese currency.

Pie Chart: Russia’s Import Partners (2024)

40% of Russian imports come from China, creating an urgent need for Yuan.

To get technical, companies that need Yuan to pay for Chinese goods can’t just swap Rubles for Yuan anymore. There isn’t enough Yuan in the system. So, businesses are taking out loans in Yuan, pushing the borrowing rates through the roof.

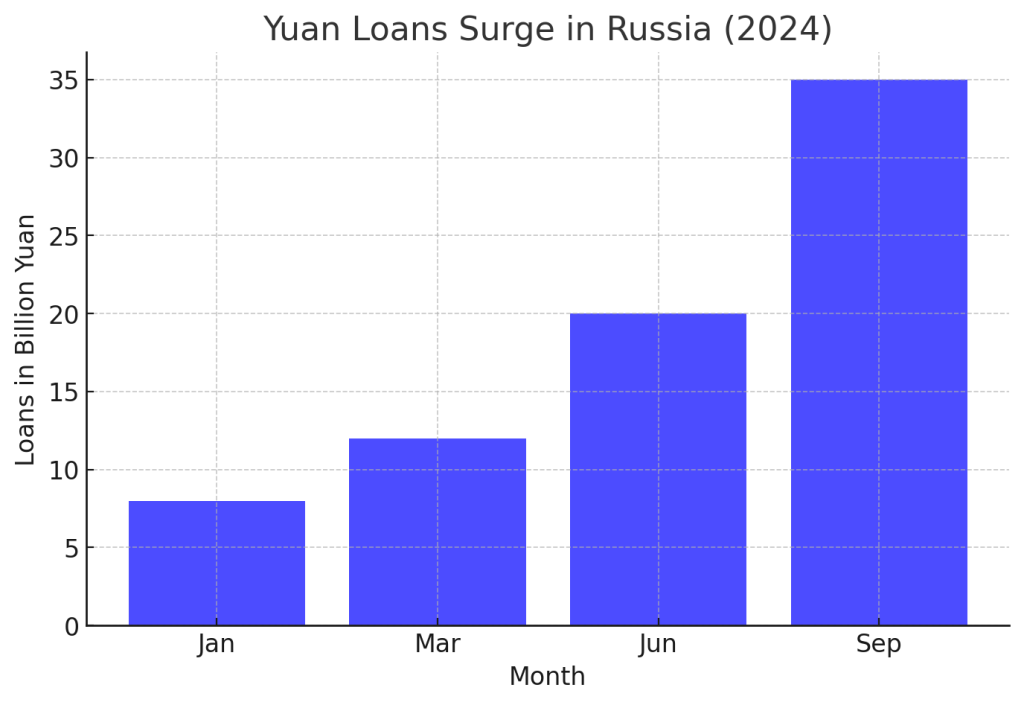

Column Chart: Yuan Loans Surge in Russia (2024)

| Month | Yuan Borrowed (in billion) |

|---|---|

| Jan 2024 | 8 |

| Jun 2024 | 12 |

| Sep 2024 | 35 |

This liquidity squeeze is making it impossible for Russian companies to operate without hiking their prices, which—surprise, surprise—leads to inflation.

The Yuanization of the Russian Economy: A Double-Edged Sword

If you think borrowing in Yuan solves the problem, think again. The cost of borrowing in Yuan has skyrocketed, doubling in just five months. In March 2024, Russian companies could borrow in Yuan at an interest rate of 4%. Now? Try 30%. Yeah, that’s not a typo.

This is why prices on store shelves in Moscow are soaring. Russian companies importing from China are getting squeezed. They have no choice but to pass on these higher borrowing costs to consumers, jacking up prices on everything from electronics to groceries.

Visual: The Cost of Borrowing in Yuan

In 2024, the borrowing cost in Yuan has jumped from 4% to 30%, leading to soaring inflation.

Sanctions, Smackdowns, and the Liquidity Shortage

Adding fuel to the fire, Western sanctions have crippled Russia’s ability to access international markets. In June 2024, the Moscow Exchange was sanctioned, cutting off Russia from trading in US Dollars or Euros. This forced even more companies to rely on the Yuan, creating a chokehold on liquidity.

China, meanwhile, is walking a tightrope. American regulators have warned Chinese banks that if they’re caught dealing with Russian entities on the sanction list, they’ll face sanctions themselves. As a result, Chinese banks have become more cautious, limiting the amount of Yuan Russia can access. It’s a vicious cycle: the more Russia needs Yuan, the less China is willing to supply.

Why This Liquidity Crisis Could Get Worse

So, where does this leave Russia? In a world of hurt. With inflation running rampant and businesses struggling to cover skyrocketing costs, the economy is poised for an even bigger collapse. The Yuanization of Russia’s economy might have started as a way to dodge sanctions, but it’s now an economic trap.

Russia’s over-reliance on China is proving to be a colossal miscalculation. The lack of Yuan in the system means borrowing costs will continue to rise, putting even more pressure on businesses and consumers alike.

The Big Picture: Russia’s Currency Crisis is About More Than Just the Ruble

While the Ruble’s downfall is the most visible sign of Russia’s economic decline, the real story is much more complex. Russia’s shift to the Yuan shows just how desperate the country has become in trying to navigate the economic storm. But in doing so, Russia has traded one set of problems (sanctions) for another (a liquidity crisis).

What Happens Next for Russia?

In the short term, expect to see more companies fold under the pressure of high borrowing costs. Inflation will likely continue to rise, and consumer confidence will hit new lows. Over the next 3 to 6 months, things are only going to get worse.

But the real question is, how long can Russia keep leaning on China before the entire economy implodes? With mounting pressure from sanctions, skyrocketing borrowing costs, and a severe liquidity shortage, it’s hard to see a way out of this economic tailspin.

What do you think? Can Russia’s economy survive this currency crisis? Or is the country too far gone? Drop your thoughts in the comments, and let’s get the conversation started. And while you’re at it, why not become a permanent resident or citizen of the "Shining City on the Web"? Join the iNthacity community where we discuss the latest in global economics, tech, and innovation. Like, share, and jump into the debate!

Disclaimer: This article may contain affiliate links. If you click on these links and make a purchase, we may receive a commission at no additional cost to you. Our recommendations and reviews are always independent and objective, aiming to provide you with the best information and resources.

Get Exclusive Stories, Photos, Art & Offers - Subscribe Today!

Post Comment

You must be logged in to post a comment.